Jakarta, February 28th, 2023 – The global economic growth has gradually improved and continues on with the recovery stage. Particularly in Indonesia, Bank Indonesia estimates that the country’s economic growth will remain strong this year, ranging between 4.5 to 5.3 percent.

Despite the positive projections to look forward to, however, Indonesia’s workforce still struggles to fully recover post-pandemic and achieve financial stability.

The post-pandemic challenges and global economic turmoil have caused a number of direct and indirect impacts on Indonesian workers.

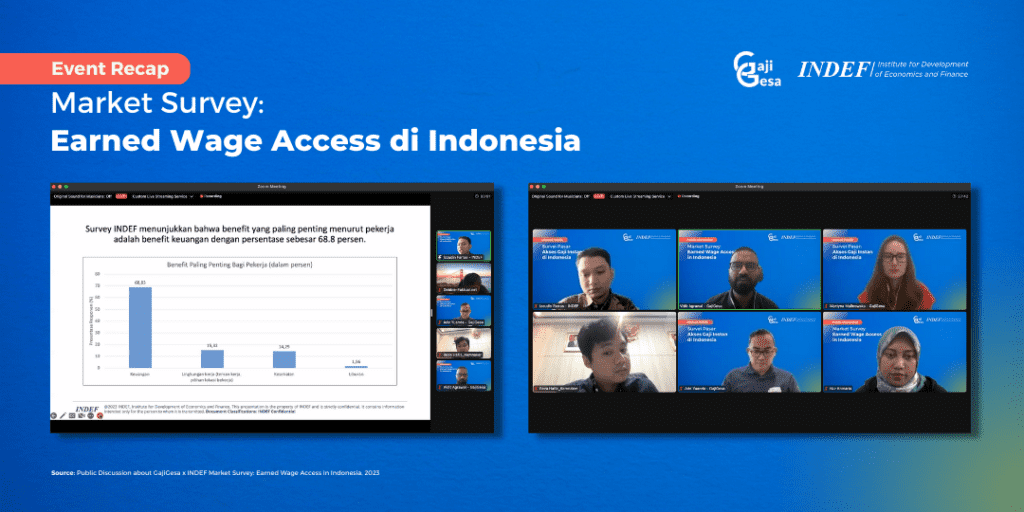

GajiGesa, the leading employee benefits and financial wellness platform that pioneered Earned Wage Access in Indonesia and Southeast Asia and the Institute for Development of Economics and Finance (INDEF) recently conducted a survey on the opportunity for EWA in Indonesia.

The survey revealed that nearly 35% of adult workers in Indonesia are dissatisfied with their current wages and find it insufficient to meet their basic living needs.

In addition, their dissatisfaction is also affected by the increasing prices of goods which is inconsistent with any incremental increase in income.

Looking back at data from the International Labor Organization (ILO) in 2019, Indonesian workers’ earnings are significantly lower compared to neighboring countries such as Malaysia, Thailand, and Vietnam.

As a comparison, while average workers in Indonesia earn USD 385 or equivalent to Rp 5 million per month, Malaysians earn around Rp 18 million of monthly income.

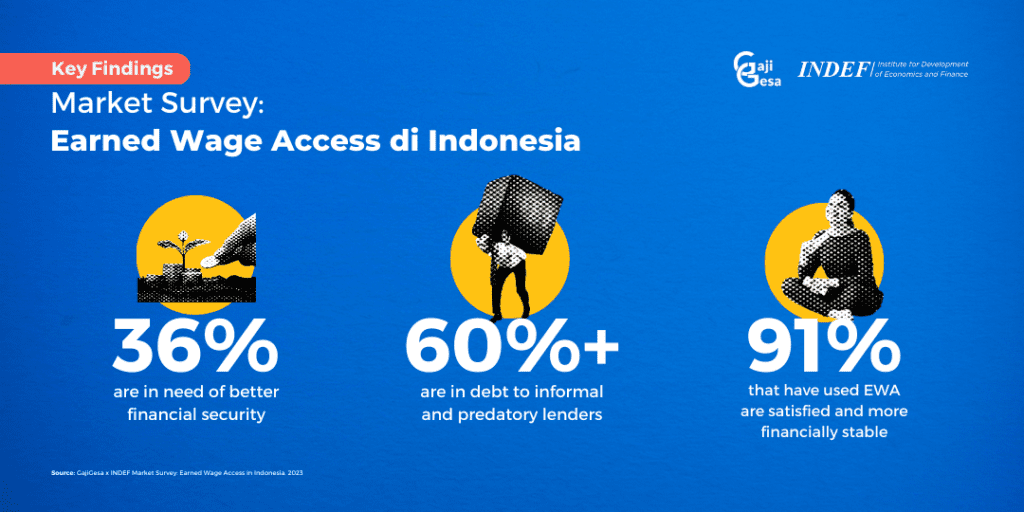

Moreover, the low income of average Indonesian workers drives a high demand for loans, with 60% of workers in active debt.

In fact, the World Bank Global Findex reported last year that only 14% of Indonesian adult workers have access to banks, while the rest had to rely on informal lenders – trapping them in a vicious cycle under predatory conditions.

“With Indonesian workers’ relatively low income, their ability to reserve funds for emergencies is also at a concerning state. Only 32.75% of them are able to have reserve funds for at least the next seven days” explained a researcher at INDEF Center of Digital Economy and SME Izzudin Al Farras Adha.

“About 52.9% of workers have financial difficulty by the end of the month, while 19% start to lack cash in the middle, and 2.8% in the beginning of the month,” he added.

The need for more inclusive financial solutions that improves long-term financial wellness is clear. GajiGesa as the pioneer of EWA in Indonesia, has spearheaded the effort to bring financial resilience and security into every workplace.

“GajiGesa is determined to make Earned Wage Access a cornerstone of inclusive financial services in Indonesia. The results of the survey are clear, employees and employers want salary on-demand solutions that unlock access, provide greater control, and improve financial security and productivity over time,” said Vidit Agrawal, Founder & CEO of GajiGesa.

“EWA platforms like Gajigesa help businesses to better optimize cash flow, increase employee productivity and protect employees from informal, predatory lenders,” he added.

Furthermore, the survey indicates that 91.4% of the respondents who have now used EWA agree that their salary feels more sufficient and 33.13% of them have not experienced any further cash shortages since then.

Meanwhile, most of the respondents who still have debts are those who have yet to use the EWA system and 35.14% of them admit that they are unable to meet their needs should there be any urgent or sudden expenses.

“It is imperative that workers are able to focus on carrying out their job without any mental burdens outside of work, especially when it comes to money. Earned Wage Access has the potential to significantly reduce financial stress and improve financial health for millions of hard-working Indonesians ,” Vidit concluded.

In October 2022, GajiGesa was the first company in APAC to launch Earned Wage Access on WhatsApp, expanding better financial access to tens of millions of workers. The company currently partners nearly 350 employers and serves over 750,000 workers across Indonesia.

*****

Additional Data Points from the Survey

- As many as 91% of respondents felt that the rate at which the cost of living was increasing was not matched by an increase in their salaries.

- 68.8% feel that the most important benefits that a company can offer to workers are monetary/financial benefits.

- 52.9% of respondents said they had difficulty holding cash at the end of the month.

- 66.87% admit that they have experienced a period of cash shortages

- As many as 60% of total respondents admitted to having debts at the time of the survey. Most of the respondents who claimed to have debt were respondents who did not use EWA.

- of the respondents who had debts more than once, 52.6% had debts of more than IDR 10 million and another 15.4% who admit to having debts in the range of IDR 2.5 million to IDR 5 million.

- 57.8% of respondents want to withdraw their salary before payday. Some respondents even wanted to receive a salary every day.

- The workers also feel that the presence of an instant salary system can also increase their ability to manage personal finance better (64.90%), hold cash (29.70%), manage personal debt (26.40%), and invest (18.90%)

About GajiGesa

GajiGesa is Southeast Asia’s fastest growing holistic employee welfare platform, dedicated to empowering millions of workers to take control of their financial lives in a dignified manner. The GajiGesa app gives employees access to their earned wages, financial knowledge, and other financial management tools to help them improve their long-term finances responsibly. It also provides partner employers with enterprise-grade workforce management solutions and HR analytics platforms to manage tracking and payroll, as well as improve employee productivity, engagement, and retention by alleviating financial stress on their teams. GajiGesa has over 300 partners and serves approximately 750,000 employees in Indonesia.

The company raised a US$6.6 million pre-Series A funding round in November 2021, led by MassMutual Ventures, with participation from new investors including January Capital, Wagestream, Bunda Group, Smile Group, Oliver Jung, Northstar Group partners including Patrick Walujo, Nipun Mehra (CEO, Ula), and Noah Pepper (Head of APAC, Stripe), among other prominent angel investors. Existing investors including defy.vc, Quest Ventures, GK Plug and Play, Next Billion Ventures also participated in the round.

GajiGesa was founded in mid-2020 by Martyna Malinowska (formerly Product Lead at Standard Chartered Bank, Product Director at LenddoEFL) and Vidit Agrawal (formerly Head of Business Development APAC at Stripe, COO at CARRO, and first employee at Uber Asia). The company is headquartered in Singapore. For more information, please visit https://gajigesa.com/

For media inquiries, please contact:

GajiGesa: [email protected]